The regulatory landscape for impact and sustainable investing is rapidly shifting, especially in Europe, with the introduction of the Sustainable Finance Disclosure Regulation (SFDR) in 2021 and its UK equivalent, Sustainability Disclosure Requirements (SDR). Navigating the regulatory landscape is particularly important for investors raising or operating impact funds.

Our Senior Associate, Fabienne Ntwa, has been advising a range of investors on SFDR. As a professional Finance & Risk manager, Fabienne has 12 years of experience in financial institutions such as BNP Paribas.

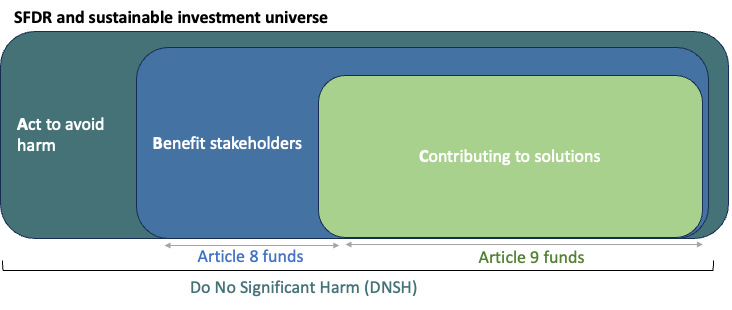

From the last years, we have seen first-hand the growing demand for clarity on SFDR Article 8 and Article 9 investments. Simply put, Article 8 investment does not pursue a sustainability objective but promote Environmental, Social and Governance (ESG) characteristics. Article 9 investment pursues a sustainability objective without causing significant harm to other sustainability criteria. We find it helpful to understand the distinction between Article 8 and Article 9 funds through the “ABC framework” from Impact Frontiers, as mapped by the visualisation below.

For funds to be aligned with Articles 8 or 9, they should also implement other SFDR articles, particularly Article 3, which requires asset managers to disclose information on the integration of sustainability factors and their impact on financial performance, and Article 4, which outlines the criteria and disclosure obligations for financial products promoting environmental or social characteristics or having a sustainable investment objective.

SFDR has undoubtedly been a welcomed development in the realm of sustainable finance. The regulatory landscape for impact and sustainable investing has witnessed a remarkable transformation, particularly in Europe, with the introduction of SFDR and SDR. These regulations bring about increased transparency and scrutiny, addressing concerns such as impact washing and improving the credibility and integrity of the financial industry. By adhering to SFDR and properly understanding the distinctions between these categories, investors can navigate the regulatory landscape more effectively, ensuring their investments align with their sustainability objectives. SFDR’s emphasis on transparency, credibility, and differentiation aligns with the aspirations of the sustainable finance community, paving the way for a more responsible and impactful financial sector.

Our typical process includes:

- Briefing session on regulatory landscape and risks of impact washing

- Diagnostic with client to review implementation of relevant articles in the regulation

- Identify gaps and create improvement plans

- Support the client in creating relevant policies and documents with to comply with the regulations

- Select metrics in alignment with EU Taxonomy (both environmental and social objectives)

We are excited to launch the advisory services on sustainability regulations together with B4Purpose, founded by Fabienne Ntwa. Please download our brochure to read more. If this is of interest to you, please e-mail [email protected]